Dutch court rules that Bitcoin is a legitimate ‘transferable value’

A Dutch court has ruled in favor of a petitioner who was owed 0.591 BTC by a private company. Significantly, the judgement classifies Bitcoin as a “transferable value” – a strong sign towards the mainstream adoption of cryptocurrencies.

The petition was filed in a Dutch court by one Mr. JW de Vries on 2 February 2018 against Koinz Trading BV, a private company, who was earlier ordered by a lower court to pay the mining proceeds of 0.591 BTC owed to the petitioner or risk paying a fine of € 10,000.

Following the failure of the company to pay the required amount in BTC, the court has now ordered that either the company pays up — or be declared bankrupt!

The court judgment states that Bitcoin shows all the characteristics of a property right, and therefore a claim to transfer BTC under property rights is valid:

The court found that there was an undisputed contract between the company and Mr. Vries, and since the undertaking was taken in Bitcoin, the amount should also be paid in the digital currency. The court qualified this legal relationship as a civil obligation to pay.

The court took note of article 1, 2, 4, 6 and 14 of the Bankruptcy Act, and commented:

The Dutch court’s judgement is definitely a positive sign towards the acceptance of cryptocurrencies as a mode of payment at par with fiat currencies issued by governments.

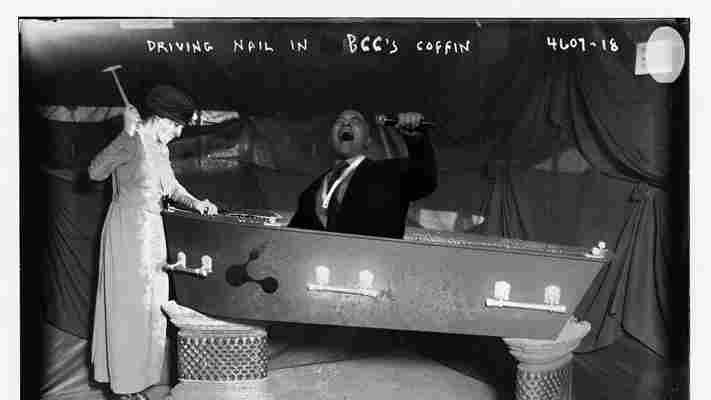

BitConnect is getting delisted from the last cryptocurrency exchange that still trades it

The final nail in BitConnect’s coffin will come September 10, when the last exchange to offer trading pairs in the controversial cryptocurrency will delist its worthless token, BCC.

For the uninitiated – BitConnect was both a pyramid and Ponzi scheme masquerading as a cryptocurrency lending platform. The more money you invested, the more dividends you were paid via a four-tiered investment system. A warped affiliate program meant actively recruiting new investors netted even greater returns.

It unravelled earlier this year when the development team pulled the biggest exit scam in cryptocurrency history . It suddenly closed the doors of its platform, leaving thousands of investors from around the world high and dry.

It’s crazy to think there’s even still a market for it – the BCC token has been absolutely useless since January. In the immediate aftermath of it being shutdown, BitConnect was served with a class action lawsuit from six investors whose losses totalled $770,000. A US court later froze all of its assets.

Until now, users have still been able to trade it on tiny cryptocurrency exchange desk Trade Satoshi. Today, perhaps spurred on by the news, over $10,000 worth of BCC has been exchanged. Astonishingly, its market cap is still over $6.5 million.

Activity has picked up though over the past few weeks, being traded at around $0.60 – way down from last year. When the scam was still running, the height of price was over $400.

But alas, we bid you goodnight, sweet Prince of the Exit Scam. If there was one, beautiful, glorious thing that came out of your bullshit, it was Carlos Matos: the greatest hype-man of all time.

He’s okay, by the way, he’s been doing a water fasting blog on YouTube. Nice!

Anyway, if you still have some BCC, for whatever reason, you have until September 10 to get rid of it. If you want. Or keep it, I don’t care.

4,000 art auction houses are putting their sales records on the blockchain

A recent merger between a blockchain-based art registry and an international auction house sales database will see sales records from over 4,000 auction houses put on the blockchain.

The art registry, Artory, has purchased Auction Club, a currently privatized database that contains information from over 4,000 international auction house sales, the Art Newspaper reports .

The acquisition will merge the two companies immediately and will make Auction Club’s sales records from over 250 businesses in 40 countries publicly available for the first time. Records will begin to show up on the blockchain-based registry some time in May.

The data held in Auction Club’s database dates back to the 1970s, including digitized information about major sales that have taken place over the last 40-plus years.

The Registry

Artory records the auction data by stamping a hash to a public distributed ledger it calls The Registry. This allows members of the public to view and cross-reference an artwork’s hash and its provenance against what is held on The Registry’s blockchain.

To add to the database you need to be registered with and vetted by Artory. So it’s not entirely “public.” It’s mostly auction houses and experts that will be vetted, Christie’s being the first.

The Registry records events in an art works life cycle like when it’s gone under auction, what it sold for, when it sold, and what it is. However, if you thought you’d get to find out who bought that latest record-breaking artwork, I’m sorry to disappoint, but The Registry doesn’t record the details of art owners.

Art-buyers are also provided a secure digital record of the history of each artwork, with digital certificates generated every time it gets sold. The idea is that this provides the greater art market with a certain confidence in an artworks’ ongoing provenance.

That said, there is one glaring security concern, the Artory Registration card .

When an auction house sells a piece of artwork, the buyer can request the auction house to complete an Artory entry and issue a digital blockchain-based certificate and registration card.

The registration card holds sensitive information like the seed phrase and “private cryptographic key,” open for the whole world to see. This key is also generated by Artory, so you can’t be totally sure you’re the only one to ever see it. Even if it is hidden behind a “scratch off panel,” it doesn’t sound particularly secure.

That said, Artory told Hard Fork that registration cards are produced offline, and the private keys are not held anywhere other than on the card in attempts to reduce the risk of hacks.

Artory further told Hard Fork, that it has not yet disclosed what rights and features card holders will be granted so it’s difficult to say exactly how they could be abused.

Back in November last year, major auction house Christie’s made history by tracking $317.8 million worth of art auctions via Artory’s blockchain , as one of the greatest privately owned collections of American Modernist art went under the hammer.

Still though, this feels like yet another “why blockchain?” moment, considering a centralized database could do pretty much the same job (and probably do it better).

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .

Update Monday, April 1, 10:32UTC:

This article originally suggested that the Artory blockchain was entirely private and permissioned. The Artory blockchain is publicly viewable and verified, but privately operated. The article has been updated to reflect this.

Leave a Comment