‘Gold-backed’ crypto firm ordered to cease operations amid pyramid scheme claims

A German cryptocurrency company that used several ex-footballers to promote its products has been told to desist its blockchain-based business amid claims that it was operating a pyramid scheme, The Guardian reports .

According to German business newspaper Handelsblatt, the country’s banking watchdog, BaFin, handed a cease-and-desist -order to Karatbit Foundation, registered in Belize, and told the company to settle any outstanding financial claims.

Founded by former vacuum cleaner salesman Harald Seiz in 2011, Karatbars leveraged Roberto Carlo’s, Patrick Kluivert’s, and Lothar Matthäus’ fame to promise users it would disrupt the financial system with its transformative currency.

The business allowed prospective “affiliates” to purchase “cryptonyzed gold ” tokens. It then awarded a commission to “affiliates” for signing up more people .

To guarantee the stability of its currency, Seiz said the company had a fully licensed “cryptocurrency bank” in Miami and a mine in Madagascar said to $991 million (£772 million) worth of gold . In its presentations , Karatbar said the mine was called Fort Dauphin, but an online mining data tool says the only mine on the island under that name only contains titanium and zircon.

Additionally, Seiz reportedly claimed to have raised more than $100m (£78m) through KaratGold’s Coin (KBC) token sale.

Aside from the financial rewards , Seiz told attendees at launch events in Cape Town, South Africa , and Amsterdam , The Netherlands , that successful affiliates would be rewarded with luxury cars and watches.

Kluivert is shown speaking at the Amsterdam event and saying: “This is a new community , a new world, this is going to be very big. The Karatbar and the cryptocoin is the future . I hope everybody will join this platform.”

“The most important thing is you have to believe,” Matthäus is heard telling the crowd.

Ongoing issues

The news comes a month after Florida ‘s financial regulator said the German company had not been granted a baking license . Earlier in the year, Namibia said Karatbar was pyramid scheme.

Then, on Monday, South Africa ’s Financial Sector Conduct Authority (FSCA) issued a warning, advising the public to avoid any dealings with the company .

Karatbars denied that its KBC cryptocoin was under investigation in a statement sent to The Guardian: “No customer or partner has ever incurred losses due to Karatbars and its products .”

The company also claimed German customers and sales partners were never sold the coin , and it was “only a free bonus gift that came with other Karatbars products .” The cease-and-desist order , the company added, was based on information about a fake Karatbars website.

“There is no cause for concern,” Seiz added in the statement. “We are on track with all our projects . This is only someone trying to get in the way of Karatbars’ success. It won’t work.”

Kluivert told Dutch newspaper Het Financieele Dagblad that he was not an ambassador for the project and claimed he had no business links with Seiz. He also denied investing in the currency.

“I was hired by an international football team friend from Spain for a guest appearance at a private event in Amsterdam ,” Kluivert said, “I did some research online prior to the event but didn’t see any negative messages.”

A representative for Matthäus denied his client ‘s involvement as an official ambassador at the event and noted he had no links with the business .

“Lothar Matthäus was invited to talk specifically about his career as a player . When he said ‘the most important thing is you have to believe’,” he was referring to his return to football after an injury, and not endorsing Karatbars’ products . Any other interpretation takes his comments out of context.”

The representative said the player had not been familiar with Seiz before he was asked to make an appearance at the event. “A routine check which is carried out before all events visited by Mr Matthäus revealed no indications of irregularities.”

Bitcoin mining consumes more electricity than 20+ European countries

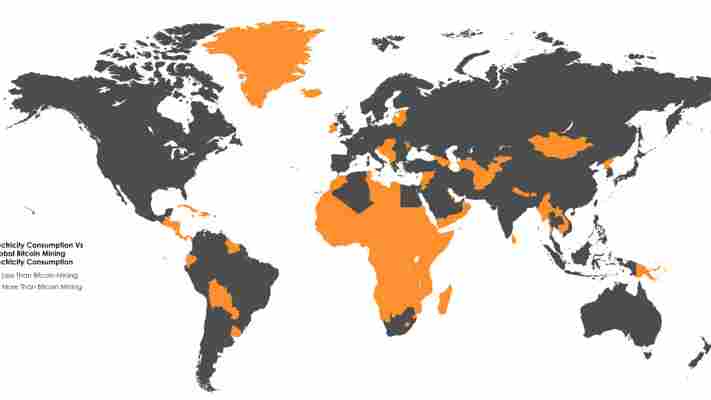

As Bitcoin continues its stride towards mainstream adoption, it turns out that its surging price rates are not the only thing experiencing a sudden increase. New research indicates that the popular cryptocurrency now consumes more electricity than more than 20 countries in Europe.

Researchers from British energy price comparison platform Power Compare have discovered that the total volume of electricity required for mining Bitcoin – the computational process that keeps transactions on the blockchain moving – now amounts to more consumption than 159 individual countries.

Among others, the list includes Ireland, Croatia, Serbia, Slovakia and Iceland.

Interestingly, only three countries out of the entire continent of Africa currently consume more electricity than Bitcoin: South Africa, Egypt and Algeria.

As far as the rest of the world goes, Power Compare mentions Ecuador, Puerto Rico, North Korea and many more.

Check out this graphic for a more detailed breakdown:

Power Compare further notes that Bitcoin’s current estimated annual electricity consumption stands at 29.05 TWh – the equivalent of 0.13 percent of the world’s overall electricity needs.

This means that, if Bitcoin miners were to found their own autonomous state, it would rank 61st globally in terms of total electricity consumption. That ought to give you a better idea why Bitcoin’s mining community played such a crucial part in the dreadful Segwit2X discussions.

According to Power Compare, Bitcoin mining has seen a nearly 30 percent increase in consumption over the last 30 days alone.

Curiously, the research points out that, assuming Bitcoin’s electricity needs continue growing at this rate, the global mining consumption could be greater than the UK’s entire electricity supply by October next year.

In case you were wondering what all this electricity bills round up to, the researchers estimate the annual Bitcoin mining electricity costs currently stand at $1.5 billion. One thing to keep in mind is that the estimation assumes mining occurs in places with low electricity rates. So the number could be even higher in reality.

Ethereum bug causes integer overflow in numerous ERC20 smart contracts [Update]

Blockchain security startup PeckShield has come across a critical vulnerability in multiple Ethereum smart contracts (based on the ERC20 protocol ) which results in integer overflow – a common issue which occurs when computers deal with numeric values outside of the range that can be represented with a given number of bits.

The researchers have noted that their study found that the bug is present in a number of tokens, including UGToken, SMART, MTC, FirstCoin, GG Token, CNY Token, MESH and SMT tokens.

According to the researchers, the bug makes it possible for attackers to “ transfer huge amount of tokens to an address with zero balance,” tacking the sender with huge fees in the meanwhile.

PeckShield remarks that while Ethereum has traditional mechanism in place to protect against such cases, it is of utmost importance to audit smart contracts thoroughly.

“ A proper way to recover from these vulnerabilities and devastating effects requires coordination and support from all eco-system members, especially digital asset exchanges,” the company wrote. “ In the meantime, we cannot over-emphasize the importance of performing a thorough and comprehensive audit of smart contracts before deployment.”

Cryptocurrency exchange desks like OKex and Huobi Pro already suspended ERC20 token trading for the time being.

“ Meanwhile, we want to point out that certain affected tokens are still tradable on some exchanges (e.g., gate.io, HitBTC, YoBit, and CoinExchange),” the researchers added. “Note that the presence of non-centralized exchanges with offline trading services could pose additional challenges as they might not be able to stop attackers from laundering their tokens.”

This is not the first time researchers have come across bugs in Ethereum-based smart contracts.

Blockchain analysts have previously warned that there are over 30,000 glitchy smart contracts on the Ethereum Network.

In fact, a month ago popular cryptocurrency exchange desk Coinbase suffered from a similar issue which technically allowed users to reward themselves with practically endless amounts of Ethereum.

Those curious about the technicalities can read the full vulnerability report on the PeckShield site here .

Update 17:13 PM UTC: Some developers have since downplayed the severity of the vulnerability report in question, arguing that the faulty function outlined by PeckShield is not even present in the ERC20 standard – and rather an instance of poor Solidity development.

[H/T Oguz Serdar ]

Leave a Comment