Researchers debunk theory that single whale caused 2017’s Bitcoin bull run

Specialist blockchain research ers have debunked an academic paper that claimed Bitcoin ‘s astronomical price surge duri ng the infamous 2017 cryptocurrency bull r un was caused by a single whale .

The paper, which Hard Fork previously reported on , claimed a whale on cryptocurrency exchange Bitfinex was allegedly able to spike Bitcoin ‘s price when it dro pped below specific levels.

Written by the University of Texas professor John Griffin and Ohio State University’s Amin Shams, the paper’s thesis hones in on the theory t hat Tether tokens are crea ted wi thout the dollars to back them, then used to purchase Bitcoin , thus driv ing up its price .

Now, a study by LongHash says that the paper’s only supporting evidence about Tether being unbacked by cas h “is a circuitous hypothesis r elated to how cash management works for Tether auditing.”

“The authors hypothesize that since Tether is due to be audited each month, it needs to sell some of its Bitcoin holdings at t he end of each month if large amounts of Tether have been issued that month, which then causes the price of Bi tcoin to drop near the end of each month. The authors present evidence that out of the 24 months in their sample, the end of month effect is indeed found to be statistically significant,” LongHash’s analysis reads.

LongHash research ers say the paper failed to account for other reasons why this may occur at the end of the month. Additionally, researchers point out how the academics themselves acknowledged that once the two most significant months, December 2017 and Jan uary 2 018, were dropped, the end-of-month effect fails to be statistically significant.

“[…] the auth ors ob serve that the Tether flowing from one cluster of whale accounts (known as 1LSg) on Bitfinex favor trading just below cut-off Bitcoin prices of around $500 increments. Using a statistical model , the authors found a large effect of these whales ‘ trading on Bitcoin price within a three-hour window , and the effects are stronger after new Tether authorization,” LongHash’s researchers said.

“The authors interpret this finding to be evidence of price manipulation . But it is widely known that whales can move short term crypto prices due to exchange slippage, so this part of the paper does not seem to contribute to its main thesis. Overall, the paper does a very poor job of convincing us that Tether is manipulating the market ,” they add.

The research

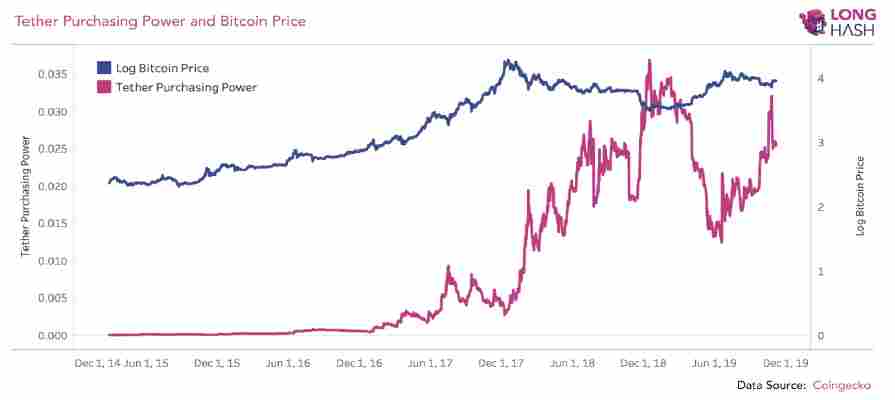

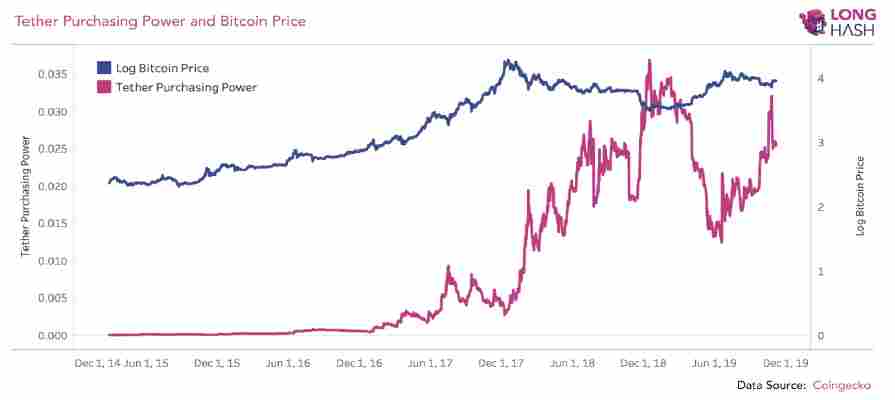

In order to assess Tether’s potential impact on the Bitcoin market , LongHash calculated a metric called the Tether Purchasing Power by dividing Tether’s market cap by that of Bitcoin.

The metric measures the amount of Bitcoin that can be bought with all the Tether supply in the market at its current spot price. The higher the ratio, the more likely it is that manipulation could have taken place with Tether.

According to the graph, Tether Purchasing Power increased until the summer during the 2017 bull run, then progressively declined until the end of the year.

It then rose significantly during the bear market, hitting its peak value at the end of last year.

According to the researchers, the data suggests that even if Tether were manipulating the market , its ability to do so was actually strongest when Bitcoin ‘s price declined — thus contradicting previous claims that Tether’s issuance generated the 2017 bull market. In fact, the data suggests that Tether ‘s supply failed to keep up during the height of the bull market.

Additionally, the researchers say Tether ‘s potential influence on Bitcoin prices tends to happen during bear, and not bull markets.

“As more and more stable coins enter the marketplace , some of the controversies surrou nding T ether may also gradually dissipate,” they added.

The current state of Bitcoin and Ethereum

While Bitcoin currently bears more resemblance to digital gold than digital cash — with its congested pending transactions log rendering it practically useless as a currency since the cancelled fork two weeks ago — the Ethereum network is looking healthier than ever and in a good position to come out of the ongoing currency war successful.

Bitcoin has been dominating both crypto and mainstream news lately, even more so than usual, with mad volatility due to its continuous fork drama and rumours of free money for anyone holding it. Bitcoin breaking new all-time highs almost on a daily basis certainly doesn’t do anything to decrease the attention.

With this one-sided media coverage, it’s no wonder no one outside the small crypto community knows that Ethereum is regularly handling around twice the daily transactions of Bitcoin, and more than most other leading cryptos combined , that Ethereum’s transfers are extremely fast compared to Bitcoin’s, or that its median transaction fees are nearly 59 times cheaper .

Some Bitcoin maximalists are calling the high transaction fees a feature. Some also say that the fact that BTC collects $1.5 million a day in fees, against ETH’s measly $200,000, is a clear indicator of real world value as it shows that people are willing to spend more money to get onto the BTC blockchain.

However, there is a difference in being willing to spend more money and being forced to. Lately, Bitcoin has lived up to its name as a great store of value, although not for the right reasons. Since the cancellation of Segwit2x, people have simply been unable to move their funds in or out. With a ridiculous number of transactions constantly waiting to be mined, you better be prepared to pay up if you want to get your transaction through in reasonable time.

In its current state, Bitcoin isn’t much more than a speculation vehicle, something to be bought and sold on exchanges (whose trades happen off-chain and therefore aren’t affected by the long confirmation times). Few people need to use it. There aren’t many companies building on it. It’s not even useable as payment anymore. But maybe it doesn’t have to be either. Maybe we should be looking at Bitcoin and other coins and tokens as an entirely new asset class, something we don’t fully understand the implications of yet.

While there are many other blockchains claiming to be able to supersede Ethereum on all of the above areas, with EOS being most vocal about it, personally I’m a bit tired of hearing about what all the projects out there could revolutionize some day.

The discussion should no longer just be about which blockchain can handle more transactions faster and cheaper, but also about which one is actually seeing the numbers required to prove its capabilities right now. There’s currently no other project competing with Ethereum when it comes to the sheer number of use cases, and developers and companies building cool stuff on top of it. Some of these teams will be building the new backend of the internet, nothing less.

After months of poking ETH with a stick it’s finally showing signs of life again.

If Metcalfe’s law and the high activity levels on the Ethereum platform can be used as any reference, the Ether price is currently heavily suppressed. Over the past week it has finally started to see some upwards movement though, moving from the safe haven that has been $300 for so long now, and just passed $400 at the time of writing.

Over the last few months, investors speculators have found comfort in the fact that price stability, consolidation, and steady long term gains are usually signs of strong fundamentals, however the past few days have regained confidence in the platform, bringing back the optimism from Ether’s last bull run back in May.

Considering that public Ethereum doesn’t have any major dapps live yet, it’s going to be interesting to see how the network scales with the increase in transactions that will come as more and more applications launch in 2018 — especially if traffic really starts picking up before Casper and other scaling measures get implemented. Right now though, the beloved and hated ICO is still arguably Ethereum’s killer app and ETH’s value is, just like BTC’s, purely a speculative one.

Disclosure: I own some Bitcoin and Ether.

Bitcoin lost $2,000 in a single day, but that’s okay – right?

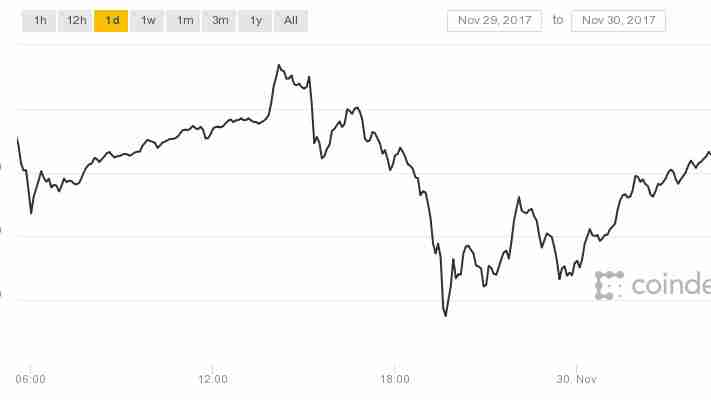

Bitcoin made cryptocurrency enthusiasts’ heads spin this week when its value first crossed $10,000 two days ago, and then surged past $11,000 . But it also alarmingly dropped by more than $2,000 within a few short hours of crossing that milestone.

Perhaps you don’t really need to worry – at the time of writing (5:38AM GMT), Bitcoin looks to be hovering around $10,370 – up from its low of $9,749, as per Coindesk .

I’ll be honest, I’m terribly risk-averse, so this roller-coaster ride makes me uneasy – but I understand that this is par for the course for folks entrenched in the crypto scene. Everything will be okay.

I think .

Leave a Comment