Satoshi Nakaboto: ‘200 Bitcoin devs assess new privacy and scaling upgrades’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Sloterdijk used to say: Bob’s your uncle!

Bitcoin Price

We closed the day, November 17 2019, at a price of $8,577. That’s a minor 0.33 percent increase in 24 hours, or $28. It was the highest closing price in two days.

We’re still 57 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $154,861,842,425. It now commands 66 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $18,668,638,897 was the highest in one day, 16 percent above the year’s average, and 58 percent below the year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 398 tons of gold.

Bitcoin transactions

A total of 264,216 transactions were conducted yesterday, which is 20 percent below the year’s average and 41 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.17. That’s $3.53 below the year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 12,479 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.0 percent of the total supply, the top 100 14.3 percent, and the top 1000 34.4 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $154 billion, Unilever has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 93.8 percent behind being on track. Bitcoin‘s price should have been $138,068 by now, according to dickline.info.

Bitcoin on Twitter

Yesterday 14,539 fresh tweets about Bitcoin were sent out into the world. That’s 21.3 percent below the year’s average. The maximum amount of tweets per day this year about Bitcoin was 41,687.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

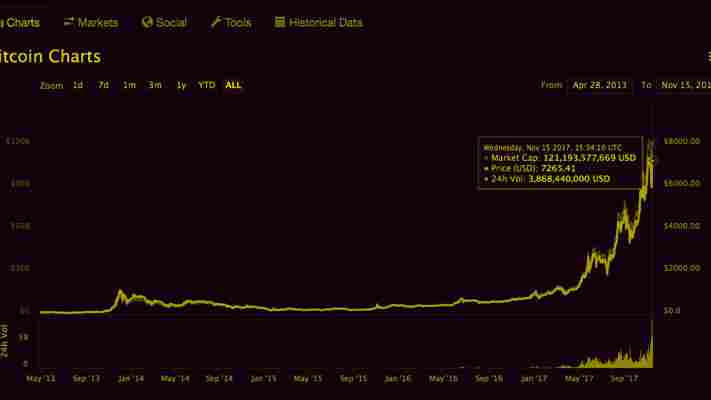

Bitcoin surges past the $7,000 barrier again

Less than two weeks after Bitcoin broke the $7,500 barrier to hit an all-time high of $7,700, the popular cryptocurrency has yet again surged past the $7,000 mark.

Despite a bumpy week which saw Bitcoin price drop to below $6,000 at one point, the cryptocurrency fluctuated around the $6,500 mark, until earlier today it passed the $7,000 threshold for the second time ever.

Here are a couple of screenshots from Coin Market Cap that will give you a better idea how Bitcoin has fluctuated over the past seven days:

In case you were wondering, the sudden jump in value amounts to an almost 10-percent increase in the last week, according to Coin Market Cap.

The cryptocurrency was slated for a controversial software update , designed to increase the blocksize, and, in the process, split the Bitcoin chain in two separate entities, creating two independent currencies.

However, facing a heated backlash from the cryptocommunity, the so-called Segwit2X update was eventually suspended for an indefinite period of time .

Meanwhile, Goldman Sachs Vice President Sheba Jafari last week speculated that the popular crpytocurrency will consolidate at around $7,941 until it eventually climbs up over $8,000.

Until then, I hope you got to score some Bitcoin on the low during last week’s dip – if not, better aim to catch the next one.

Video app Cheez is rolling out a cryptocurrency integration… but it’s centralized

Social video app Cheez, which boasts over five million installs across Android and iOS, is rolling out a cryptocurrency integration that will let users earn Bitcoin (BTC) and Ethereum (ETH). But there are a few caveats: the reward ceiling is pretty low – and the integration is mostly centralized.

The video app, developed by livestreaming household name LiveMe , will require users to complete a series of daily tasks (anything from sharing videos to uploading content) to earn their coins.

But before you get your hopes up Cheez might be a new career avenue, the daily limit for rewards is capped at 0.00352 ETH or 0.000241 BTC – about $1.50 at the current rates . So not exactly enough to make a living out of posting short clips online.

“This new integration with Contentos allows us to reward our users for their daily contributions to the Cheez community, while also introducing a new audience to crypto and blockchain,” LiveMe CEO Yuki He told Hard Fork.

”We believe blockchain has the potential to revolutionize the digital content industry, so we’re excited to lead the way and start getting people excited about cryptocurrency and the underlying technology,” she continued.

The nitty-gritty

The integration was developed “in partnership with” blockchain startup Contentos, which promises to “ decentralize the mobile content ecosystem and empower independent creators.” Ironically, Contentos founder Mick Tsai revealed to Hard Fork the company will leverage a “centralized server” to get the functionality off the ground.

As part of the collaboration between the two companies, Cheez will also enable rewards in Contentos’ Ethereum-based ERC20 token, COS. Of course, there is a catch here too.

For one, there is a limit: users can only get rewarded with COS once for each of the 15 daily tasks.

While users will be eligible to receive COS tokens for each completed task, they will only be able to claim Bitcoin or Ethereum rewards for every three, six, and 10 tasks completed. The downside is that COS tokens have no value outside of Cheez. Indeed, the token has not yet been listed on any exchange desks.

That said, users can lavishly spend their COS tokens on special features within Cheez – like using AR filters and contacting their favorite creators (because who doesn’t love paying for the right to talk to their idols). If not, users can hold onto their COS and hope the token gets listed on an exchange desk in the near future.

“ We’re planning to list COS on a top-tier crypto exchange later this year so that LiveMe and Cheez users will be able to trade with other crypto[currency] or fiat,” Tsai told Hard Fork. Unfortunately, the company has yet to specify a clear timeline for this.

On the bright side, you can do as you wish with the Bitcoin and Ethereum you’ve earned.

“ Users can transfer their BTC and ETH holdings from the embedded digital wallet within Cheez to other crypto wallets or exchanges to convert them to fiat,” Tsai added. It is worth noting that all transaction fees will be handled by the user.

For the record, there is nothing stoping users from withdrawing their COS tokens to their wallet too – other than completing Contentos’ know-your-customer (KYC) process. But the issue is that there is no real use for them outside of Cheez for the time being. That, and users will have to foot all gas fees for facilitating a transaction between Cheez and their preferred third-party wallet for Ethereum.

Why blockchain?

Cheez insists the goal with this integration is to open up new venues for cryptocurrency mass adoption. “ While blockchain and cryptocurrency are poised to reshape the future global economy and the way people engage and transact with one another, the industry has yet to see successful adoption among the masses,” the company told Hard Fork.

But considering all the limitations and workarounds in the current implementation, the collaboration hardly feels like an example of a “real” blockchain use case.

Indeed, Contentos confirmed that all COS-powered interactions within Cheez are handled through a server – and not immediately recorded on the Ethereum blockchain.

“We are not directly leveraging the Ethereum blockchain to complete all COS transactions,” Tsai told Hard Fork. “Since we’re introducing a new concept to millions of non-crypto users, we see this as the transition phase that leverages a centralized server to store all COS.”

“ Not only is it infeasible based on Ethereum’s current performance,” he continued, “it’s also hard for typical social media users to understand the concept of wallets and ERC20 tokens.”

Tsai is not wrong. Indeed, Ethereum founder Vitalik Buterin would likely agree with him.

Leave a Comment