Scam alert: Fake MetaMask app on Google Play is stealing users’ ETH

The epidemic of phoney cryptocurrency apps continue to float heedlessly on the Play Store, and Google can’t seem to do anything about it.

Security researcher Lukas Stafanko has found yet another phishing app on the Google Play Store — this time it is an imposter of Metamask, a popular Ethereum DApp Browser.

Just last week, we had reported that Google Play is hosting a disturbing amount of cryptocurrency phishing applications.

The fake MetaMask app is at least the fourth phoney app to get through Google Play, after at least two fake MyEtherWallet apps , and a fake Poloniex phishing app .

It is not known whether a lot of users have fallen for the previous scams, but the app was downloaded more than 500 times, according to Stefanko.

The reviews for the MetaMask app on the Play Store however show that at least a few users have fallen for this scam.

“The owner of this app is a thief. He stole all my Ethereum. Please block the owner of this application. It’s a scam app”, one user complaint.

“Spam Site [app]. I lost $2700”, another user said in his review.

It is worth noting that Metamask does not itself have any app on Google Play Store. It comes as a web browser extension for Google Chrome, Mozilla Firefox and Opera.

As of press time, the app seems to have been deleted or removed from the Play Store.

H/T Lukas Stefanko

Bitcoin’s median transaction fee lowest since 2011 — nearing BCH

The transaction fees and time involved with Bitcoin have been some of the biggest hurdles in the adoption of the cryptocurrency as a medium of exchange. While multiple cryptocurrencies have emerged touting themselves as the solution — without actually providing any — things seem to be getting better for Bitcoin meanwhile.

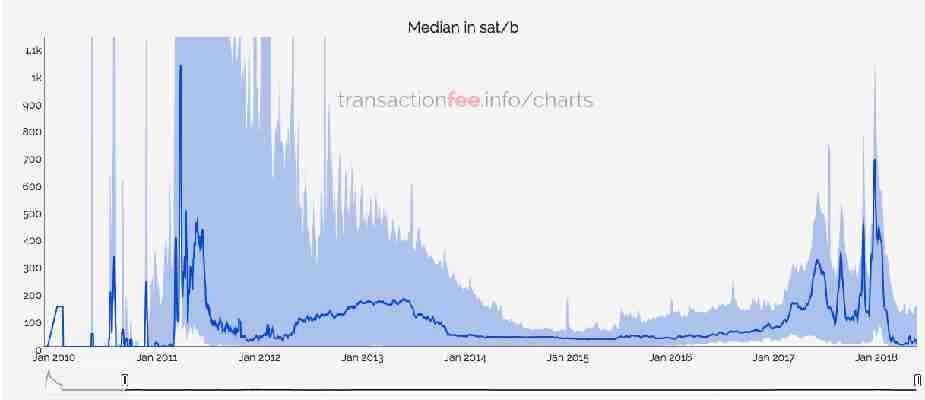

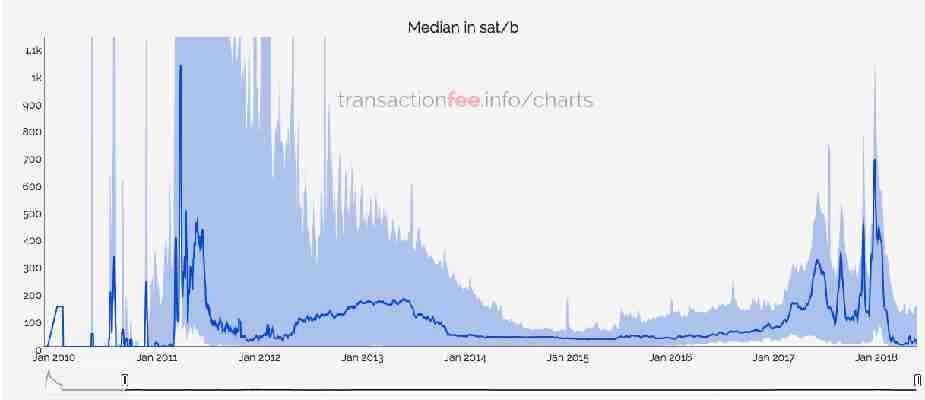

The median transaction fee rate for Bitcoin has been some of the lowest since 2011 in the last three months.

As per transactionfee.info statistics , the median fee rate for Bitcoin hit the lowest on April 4 and 5 at 6.86 satoshi/bytes (sat/B). The fee rate increased to 39.29 on April 30, but has since come down again.

The transaction fee rate came under 10 again on Saturday (9.43), and closed on 8.86 on Sunday.

This is a quite a decline from the beginning of this year. The transaction fee rate was 453.57 sat/B on the New Year’s Eve — a graph that has sloped significantly downward since then.

The low fee rate indicates that it is getting cheaper to transfer Bitcoin among different wallets. The high costs and time involved with Bitcoin transactions led to a controversial split of Bitcoin’s blockchain — creating Bitcoin Cash (BCH).

Bitcoin Cash promised faster and cheaper transactions as compared to Bitcoin. While the gap between the median transaction fee rate was overbearing initially, it seems that this gap has closed to negligible in these last three months as well. The median transaction fee rate was $34.095 for Bitcoin in comparison to the $0.0333 USD for Bitcoin Cash, but on Sunday it was a meagre $0.113 compared to the $0.0038 for Bitcoin Cash.

Bitcoin’s soft fork Segregated Witness (SegWit) has been seeing exponential adoption — a fact that could explain the reduced transaction fee-rate. While only 28.34 percent of all transactions were utilizing SegWit, the number is close to 38 percent on Sunday. The transaction fees involved in the SegWit transactions are fairly lower — at the moment, they amount to only 18 percent of the total transaction costs in spite of contributing 38 percent of the total transaction volume.

With further adoption of SegWit and Lightening Network (LN) , Bitcoin’s scalability problems are expected to resolve . While Lightening Network, which promises to make Bitcoin transactions faster and cheaper— is still in a nascent stage, the development has been impressive so far. The LN network capacity crossed $150,000 last month, and near-instant successful transactions have already been made through the network.

With reduced costs and time incurred with Bitcoin transactions, it may finally become viable to buy coffee and doughnuts with it.

Ethereum breaks the $400 barrier to hit an all-time high

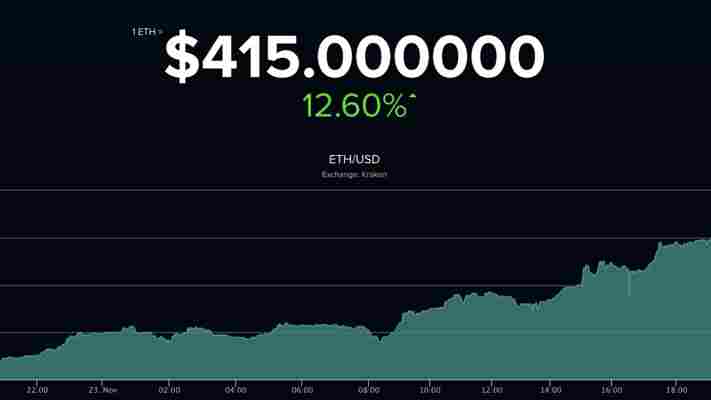

Bitcoin is not the only cryptocurrency experiencing a healthy increase in price these days: Ethereum has suddenly surged past the $400 mark to hit an all-time high price value.

After months of fluctuating at around $320, the second biggest cryptocurrency by market share managed to surpass the $400 threshold to set a record high price of $414 (at the time of writing), according to data from EthereumPrice .

For context, this amounts to a little more than a 13-percent jump in price over the last 24 hours. Check out this graph for more details:

In addition to its new all-time high price, Ethereum now boasts a market cap of nearly $40 billion, coming second only to Bitcoin’s $137 billion market share.

While the price of Bitcoin is about 20 times higher than Ether, one department where Ethereum still has a massive edge is in the efficiency of its blockchain. Ethereum currently processes about twice as many transactions as Bitcoin every day; and does so at significantly lower costs, between five and six times lower to be exact.

What is particularly interesting about Ethereum’s price hike is that it happens only two weeks after a critical vulnerability in the Parity wallet left hundreds of users without access to their Ether. According to estimates, the total amount of frozen funds is between $150 and $300 million worth of Ether.

Leave a Comment