The Ethereum Scam Database helps you avoid cryptocurrency scammers

The exponential growth the cryptocurrency and blockchain markets are currently experiencing has made the space a breeding ground for all sorts of hacks, malicious activities, and phishing traps . But there is a nifty tool that can help you steer clear of this sort of trouble.

The Ethereum Scam Database (EtherscamDB) is a handy website that collects crowdsourced information about heaps of online scams in order to guide rookie cryptocurrency enthusiasts away from falling victim to malicious actors, seeking to snatch their precious coins and empty their wallets.

Since its launch last year, the website has registered a total of 2,614 potentially fraudulent pages, linking them back to 223 different addresses (used by purported scammers to store stolen funds). Fortunately though, most of these have already been resolved.

For context, EtherscamDB indicates that only 253 of all potentially malicious pages registered are currently active.

What is especially helpful is that EtherscamDB conveniently displays the precise nature of the attack, the original URL where the scam was first noticed, as well as some additional information describing the precise attack vector in more detail.

In addition to that, the website also has a field dedicated to showing precisely which company/service the malicious link is targeting. This should make it easier to filter your search down exclusively to the services you use.

The only problem I’ve encountered using EtherscamDB is that it tends to struggle with server issues pretty often. In fact, the site went down as I was writing this post.

Still, it’s awfully handy for navigating the crypto-space right now, given that scams are growing more frequent of late.

Google was flush with links pointing to malicious copycats of popular exchange desk, Binance. More recently, popular Ethereum wallet, MyEtherWallet (which is responsible for maintaining EtherscamDB), received a slew of complaints from users, reporting someone had stollen their funds. Then there are the almost daily reports of stolen funds from Redditors who unknowingly hand over their private keys to phishing scammers.

Meanwhile, anybody who happens to stumble upon new cryptocurrency scams ought to report such suspicious activity to EtherscamDB. You can use this link to do so.

Update: EtherscamDB went down again as I was writing the piece. We’ve contacted MyEtherWallet and will update this piece one they’ve sorted out the issues.

Update 2: MyEtherWallet has reached out to inform us that EtherscamDB is now back up and running.

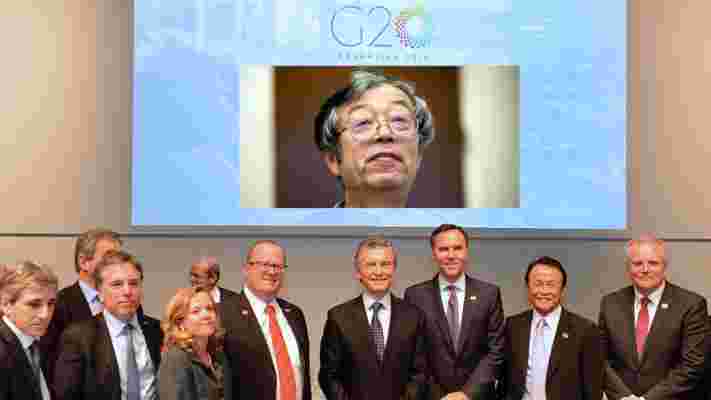

G20: Cryptocurrencies are okay, blockchains are great, and money laundering is still a problem

G20 – an international economic consortium with 20 member states including China, France, Germany, Argentina, and Canada – has announced it believes cryptocurrencies pose no significant risk to global financial stability… but they could lead to a series of money laundering violations .

In a new report published on July 21, G20 maintains that blockchain technology use cases like cryptocurrencies could do great things for the budding world economy, but there are still some security concerns that need to be addressed.

“Technological innovations, including those underlying crypto-assets, can deliver significant benefits to the financial system and the broader economy,” the G20 report reads . “Crypto-assets do, however, raise issues with respect to consumer and investor protection, market integrity, tax evasion, money laundering and terrorist financing.”

Referring to research conducted by anti-money laundering (AML) initiative Financial Action Task Force (FATF), G20 found that 17 percent DNFBPs in G20 jurisdictions had no AML measures in place – nor did they have any mechanisms aimed at ‘combating the financing of terrorism’ (CFT).

Designated non-financial businesses and professions (DNFBPs) are classified differently depending on the country, but they typically include auditors, lawyers, dealers in precious metals and stones, real estate agents, trusts, and even casinos.

“Virtual currencies [and] crypto-assets facilitate easy online access and global reach which make them attractive to move and store funds for money laundering and terrorist financing,” G20 added.

“The FATF is actively monitoring the risks associated with virtual currency [and] crypto-asset payment products and services,” the report continued. “Besides small-scale drug trafficking and fraud, the link between virtual currencies [and] crypto-assets and other predicate crimes appears to be growing.”

One of the reasons behind this disturbing trend might have to do with the fact that currently it is up to the discretion of each member state to monitor whether local institutions ensure compliance with the FATF guidelines and other appropriate AML-CFT protocols.

Even then, that decision normally falls on the local financial institutions. Depending on the country, actively staying compliant can be very costly – and it is for primarily this reason that large financial institutions are not touching cryptocurrencies.

Western Union, for example, already spend over $200 million a year on making sure they are internationally compliant with guidelines like the ones passed down by the FATF. This is without the added costs that would be associated with adopting digital assets into its global payment network.

One thing to point out is that G20 has said that the (FATF) guidelines for curbing money laundering and the financing of terrorism do not refer explicitly to virtual currencies, and as such the consortium will await further clarification in October.

Cryptocurrency bigwigs invade the Fortune ’40 Under 40′ list

Fortune has released its annual 40 Under 40 ranking which celebrates the most influential entrepreneurs under the age of (you guessed it) 40. The latest edition features several founders and executives from the cryptocurrency and blockchain space.

Founder of Ethereum , Vitalik Buterin and founder of Coinbase , Brian Armstrong, continue to feature on the list having both been members of this “club” since 2016. In addition to Buterin and Armstrong, Fortune has also granted a spot to Robinhood founders Vlad Tenev and Baiju Bhatt, both of whom are making their debut on the list.

While not strictly a blockchain entrepreneur, it is worth pointing out that Telegram CEO Pavel Durov has also made it to the 40 Under 40 list. Considering Telegram raised $1.7 billion in an initial coin offering ICO last year, this makes for a total of five cryptocurrency influencers on the list.

Factoring in the explosion of interest in cryptocurrencies and blockchain over the past year, it is hardly surprising that blockchainpreneurs account for such a significant chunk of Fortune’s list.

While the presence of cryptocurrency entrepreneurs in 40 Under 40 is somewhat expected given the sector’s rapid growth, it is pretty wild to see blockchain executives next to household names like Mark Zuckerberg, Rihanna, and Donald Glover (more commonly known as Childish Gambino).

The question is: have Buterin and company earned this accomplishment?

One thing to keep in mind is that unlike Zuckerberg and other seasoned entrepreneurs on the list, blockchain entrepreneurs are yet to prove their companies can live up to the hype.

Ethereum, for instance, is still dealing with scaling issues ; and with all the regulatory chaos around the globe, the future of exchanges like Coinbase and Robinhood is still uncertain.

Still though, making it to Fortune’s 40 Under 40 is a big deal – and the fact that there are five cryptocurrency entrepreneurs on the list is a success for the entire blockchain field. In the end, time will tell whether these blockchainpreneurs really deserved their positions in the list.

Leave a Comment