Visa no longer blames Coinbase for cryptocurrency overcharge bug [Updated]

Update: Visa has corrected its vague statement with regards to the Coinbase technical issue which resulted in overcharging multiple cryptocurrency buyers. Previously, the company denied fault for the issue, practically shifting blame back to the popular exchange desk.

The company has now released another statement, together with payment processing service Worldpay, which suggests the issue might not have been Coinbase’s fault after all. Still, the statement conveniently refrains from naming the culprit for this massive blunder.

“Over the last two days, some customers who used a credit or debit card at Coinbase may have seen duplicate transactions posted to their cardholder account.”

“Worldpay and Coinbase have been working with Visa and Visa issuing banks to ensure that the duplicate transactions have been reversed and appropriate credits have been posted to cardholder accounts,” the statement continues. “All reversal transactions have now been issued, and should appear on customers’ credit card and debit card accounts within the next few days.”

“We believe the majority of these reversals have already posted to accounts,” it adds. “If you continue to have problems with your credit or debit card account after this reversal period, including issues relating to card fees or charges, we encourage you to contact your card issuing bank.”

While it is great to hear that customers will get refunds, it is quite disappointing to see that seemingly all companies involved have quietly gotten away without accepting responsibility for this mess.

Meanwhile, there is still no clear timeline on when customers can expect to receive their money back.

Following a technical issue which resulted in Coinbase overcharging numerous cryptocurrency buyers for up to 50 times their original purchase, VISA has now come out to blame the bug on the popular exchange desk.

“Visa has not made any systems changes that would result in the duplicate transactions cardholders are reporting,” a Visa spokesperson told TNW. “We are also not aware of any other merchants who are experiencing this issue.”

“We are reaching out to this merchant’s acquiring financial institution to offer assistance and to ensure cardholders are protected from unauthorized transactions,” the statement concluded.

This dreadful situation first started shaping up when tons of Coinbase users rushed to Reddit to complain that the cryptocurrency exchange desk has wrongly charged them multiple times for their original purchase – some buyers claim they’ve been charged for up to 50 times the intended purchase .

Shortly after the news broke, Coinbase reached back to TNW to clarify that its team is investigating the issue, speculating it might have to do with recent changes to the MCC code by banks and financial institutions.

“ This is related to the recent MCC code change by the card networks and card issuers charging additional fees,” Coinbase told TNW. “We have identified a solution and future purchases will not be affected. We will ensure any customer affected by this issue is fully refunded. We expect these refunds to happen for customers automatically through their bank.”

Shortly after that, the company took to Twitter to shift the blame to Visa.

Coinbase has since assured users that the accidental charges will be refunded. Unfortunately, the company was unable to provide TNW a clear timeline for the refunds.

“W e’ll work with banks to ensure refunds are processed as soon as possible,” a Coinbase spokesperson told us over email. “In many cases we expect that many refunds should happen automatically.”

While Visa and Coinbase are fighting over who should take responsibility for this massive blunder, heaps of affected cryptocurrency investors have cried out that the accidental multiple charges have practically emptied out their bank accounts.

RIP ICOs: Blockchain startups receive $3.9B funding the old fashioned way

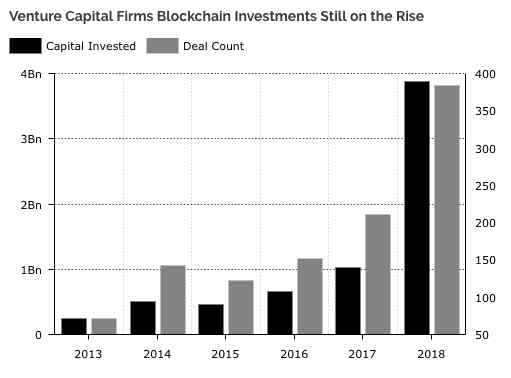

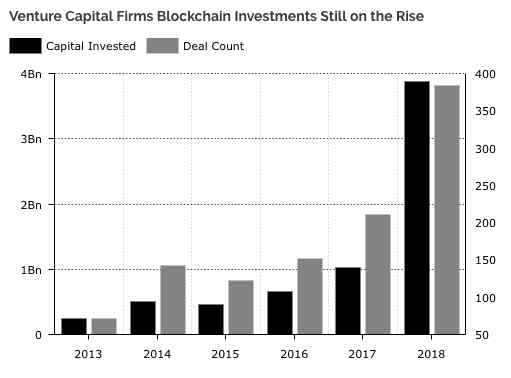

Despite 70 percent of ICOs being worth less than they initially raised, venture capital (VC) firms are still ramping up blockchain investments. Already, traditional investors have sunk $3.9 billion into new blockchain and cryptocurrency businesses in 2018.

Not only has the number of deals struck between VCs and blockchain startups effectively doubled in the past 12 months, but the average deal size has increased by $1 million, blockchain research group Diar reports.

Altogether, the $3.9 billion being funneled into blockchain and cryptocurrency startups represents a 280-percent rise on funding over the last year.

While there is certainly a lot of money being spread across many projects – the 10 largest funding deals in the blockchain sector amounted to over $1.3 billion. Of those companies, just one has a native token.

Remember when they said ICOs would kill traditional investment structures?

Here is a list of the top 10 investment deals, in terms of equity raised. Bitmain, R3, Circle, Ledger, and Paxos have all featured predominantly in the news of late, and note the banks peppered in for good measure.

Diar also notes that there are close to “2,000 investors who have invested in at least one blockchain company.” Of the top 50 most active VCs, approximately half exclusively fund startups within the blockchain industry.

So, while the ICO market might seem bleak – the funding hasn’t exactly disappeared – it’s just gone legit . This could be thanks to increased pressure from government regulators like the SEC.

After all, the data indicates that 79 percent of VCs investing in blockchain startups are based in the US – where ICOs are illegal.

RIP the ICO , long live the VC.

If you’re interested in everything blockchain, chances are you’ll love Hard Fork Decentralized. Our blockchain and cryptocurrency event is coming up soon – join us to hear from experts about the industry’s future. Ticket sales are now open, check it out!

Bitcoin exchanges crash day after US demands cryptocurrency transaction info

Cryptocurrency exchanges are crashing, Bitcoin is fluctuating like an electrocardiogram hooked up to someone at a pie-eating contest, and the US government is turning its eye on big ticket Bitcoin transactions. It’s a crappy day to be a crypto enthusiast.

Coinbase and Gemini, two of the world’s most popular cryptocurrency exchanges, are both having a difficult time completing transactions over the last few hours.

Reports indicate most users are unable to even log in. If that weren’t bad enough, Coinbase may also be getting demands from US courts to turn over transaction documents. Is this what it looks like when a bubble bursts?

At the time of writing both sites still appear to be having this problem, with users on Reddit claiming that some transactions are being denied due to problems with “banking partner,” while others flat out can’t log in. Yikes.

Now, before anyone panics let’s examine the situation. Bitcoin dropped in value close to the $9,000 mark – losing nearly 2K in a couple of hours – but it’s back up over $10,000 currently. That’s the good news.

The bad news is, according to a tweet from Professor Alan Woodward, a security expert from University of Surrey, Coinbase has been subpoenaed with a request for records of all transactions in amounts over $20,000 between 2013 and 2015.

It’s likely this request indicates we can expect some information in the form of regulatory news (taxes), at least out of California where the document was filed.

There’s not much reason to believe there’s any relation between Coinbase’s inability to process transactions, Bitcoin losing thousands, Gemini crashing, and this legal action. The smart money is on caution.

There’s been a thousand ‘get out while you still can’ scenarios for cryptocurrency (Bitcoin in particular). But for every one of those cases there’s even more people who wish they’d held on.

The fact that Bitcoin is already rebounding from its intraday low seems to indicate the best strategy for now is to wait and see how the rest of the week plays out.

Still, best give your accountant a call to be on the safe side.

We’ve reached out to cryptocurrency experts for comment and will update as we learn more.

Leave a Comment